Navigating Bad Credit Contract Mobile Phones: A Comprehensive Guide

Bad Credit Contract Mobile Phones – bad credit is generally defined by a low credit score, which reflects an individual’s creditworthiness and financial history. Credit scores typically range from 300 to 850, with scores below 580 often categorized as bad credit. These scores are derived from information contained in an individual’s credit report, which chronicles their borrowing and repayment activity. Different factors contribute to the determination of a credit score, including payment history, credit utilization, length of credit history, types of credit in use, and new credit inquiries.

Payment history is the most significant factor, accounting for about 35% of a credit score. Delinquencies, such as missed payments or defaults, can severely impact this aspect. Credit utilization, which refers to the ratio of credit card balances to credit limits, follows closely behind; maintaining a lower utilization ratio is crucial for a favorable score. Moreover, the length of credit history influences the score, as lenders prefer borrowers with a proven track record of managing credit responsibly.

Having bad credit can significantly limit financial opportunities, especially when it comes to mobile phone contracts. Many mobile service providers conduct credit checks before approving contracts, as they aim to mitigate risks associated with potential defaults on payment. Consumers with bad credit are often viewed as high-risk borrowers; consequently, they may face higher deposits, limited contract options, and potentially elevated monthly payment rates. Additionally, companies are more likely to restrict access to premium devices or services for individuals with poor credit history.

Understanding the elements of bad credit is crucial for consumers seeking mobile phone contracts. By addressing the root causes of their low scores through responsible financial behaviors, individuals may not only improve their credit ratings but also enhance their prospects for obtaining favorable mobile phone agreements in the future.

Understanding Mobile Phone Contracts

Mobile phone contracts are formal agreements between a consumer and a mobile service provider that outline the terms of service for accessing telecommunication services, including voice calls, text messaging, and mobile internet. Typically, these contracts are for a duration of one to two years and are designed to provide customers with subsidized access to smartphones and other mobile devices. This arrangement allows consumers to acquire the latest technology without paying the full price upfront, as the total cost of the device is spread out over the life of the contract.

One of the primary advantages of entering into a mobile phone contract is the ability to access high-quality devices at a reduced initial expense. Along with the device, consumers also receive a set monthly plan that generally encompasses data allowances alongside unlimited or set numbers of call minutes and messages. This structured payment approach can be financially beneficial for individuals who prefer to manage their expenditures in predictable monthly installments.

However, it is essential to consider the financial commitments that come with mobile phone contracts. Consumers are typically bound to a contract for a fixed term, which means they are liable for monthly payments for the duration of the agreement. These payments can vary significantly based on the chosen plan, features, and the model of the device. Additionally, there may be fees for exceeding data limits or early termination penalties should a consumer decide to cancel the contract before the agreed period concludes. Understanding these terms is crucial to avoid unexpected charges and ensure that the chosen mobile contract aligns with one’s financial situation.

Challenges of Getting Mobile Contracts with Bad Credit

Individuals with bad credit often encounter significant hurdles when attempting to secure mobile phone contracts. One of the primary challenges faced is the increased likelihood of being denied a contract altogether. Mobile carriers assess the creditworthiness of applicants through a credit check process, and those with poor credit histories are typically viewed as higher-risk customers. As a result, many service providers may reject their applications or offer terms that are less favorable than those extended to individuals with good credit.

Should approval be granted, it is not uncommon for individuals with bad credit to be required to pay a substantially larger deposit. This upfront payment serves as a form of security for the mobile phone provider, mitigating the risk associated with potential missed payments in the future. The amount of the deposit can vary significantly depending on the provider and the perceived credit risk of the applicant; however, it often represents a financial burden that can deter individuals from proceeding with the contract.

Further complicating matters, those able to secure a mobile contract despite their poor credit may find themselves subject to stricter terms and conditions. Contracts may include higher monthly payments, limited access to premium plans, or a reduced selection of available devices. Some providers might impose caps on data usage or restrict the ability to upgrade to newer models. These limitations serve as a reminder that having bad credit not only impacts outright approval but also the overall experience of utilizing mobile phone services.

In essence, individuals with bad credit face multiple obstacles in the pursuit of mobile contracts, marked by the specter of denial, elevated financial requirements, and stringent terms. This scenario underscores the importance of understanding the landscape of mobile phone contracts, particularly for those navigating the complexities of adverse credit situations.

Types of Mobile Contracts Available for Bad Credit

Navigating the landscape of mobile contracts can be particularly challenging for individuals with bad credit. However, there are several options available that cater specifically to this demographic. Understanding these types of contracts can empower consumers to make informed decisions that suit their financial circumstances.

One of the most popular options for those with poor credit histories is the no credit check contract. These agreements do not take the applicant’s credit score into consideration, making them accessible even to individuals who might otherwise be rejected. Typically, this type of contract comes with shorter terms and may require a larger upfront payment; however, it allows users to enjoy the benefits of a mobile device without the burden of credit scrutiny. It is important for consumers to assess their usage carefully, as exceeding the plan’s limitations can lead to higher charges.

Another alternative is the pay-as-you-go plan. This option enables users to pay for their services in advance, which effectively eliminates the risk of accumulating additional debt. Pay-as-you-go plans often come without a contract, allowing flexibility and control over expenditure. While this choice is advantageous for budgeting purposes, the downside may include higher per-minute or per-text rates compared to traditional plans.

Secured contracts represent another viable option for those with bad credit. In these agreements, the consumer is required to make a security deposit, which can act as collateral against any financial risk to the service provider. This initial payment may be returned after a satisfactory payment history, allowing consumers to rebuild their credit. While secured contracts often include more favorable terms than no credit check contracts, their requirement of a deposit may be a hurdle for some applicants.

Choosing the right mobile contract is crucial for individuals with bad credit, and weighing the advantages and drawbacks of these options can lead to better financial health and improved access to communication services.

Tips for Securing a Bad Credit Contract Mobile Phones

Navigating mobile phone contracts with bad credit can be a daunting task, but there are strategies that individuals can employ to improve their chances of securing a contract. One of the first steps to consider is taking proactive measures to improve one’s credit score. Regularly checking credit reports for inaccuracies and disputing errors can potentially increase credit ratings. Additionally, making consistent and timely payments on existing debts can gradually enhance overall creditworthiness. It may also be beneficial to reduce outstanding debt by focusing on paying down credit cards, as lower credit utilization ratios can positively impact credit scores.

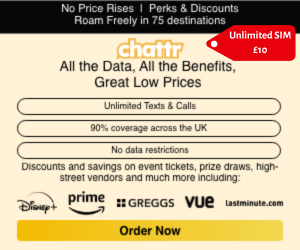

Exploring specialized lenders or mobile providers that cater specifically to individuals with bad credit is another viable approach. Several companies understand the challenges faced by those with less-than-ideal credit histories and offer tailored services. These providers may require larger upfront payments or offer higher interest rates, but they often provide a path to mobile phone contracts when traditional options are unavailable.

Another effective strategy for securing a mobile phone contract is considering a joint contract with a creditworthy co-signer. A co-signer can be a family member or friend who has a positive credit history, and having one can significantly improve the chances of approval. This arrangement not only shares the financial responsibility but also demonstrates to the lender that there is a reliable individual backing the agreement. However, it is crucial that both parties are fully aware of the terms and obligations of the contract, as any missed payments could adversely affect the credit ratings of both individuals.

In conclusion, successfully securing a mobile phone contract with bad credit involves a combination of improving credit scores, exploring specialized lenders, and leveraging the support of a creditworthy co-signer. Each of these strategies can enhance one’s chances of obtaining a favorable mobile phone contract, ultimately enabling individuals to communicate effectively despite their financial circumstances.

Reputable Providers Offering Bad Credit Contracts

Navigating the world of mobile phone contracts can be particularly challenging for individuals with bad credit. However, several reputable service providers recognize this issue and offer contracts tailored to those with less-than-perfect credit histories. These providers often emphasize inclusivity, allowing customers to access essential communication services despite their financial backgrounds.

When seeking a mobile contract for bad credit, it is integral to consider certain key features. First and foremost, the quality of customer service stands out as a crucial factor. A provider that offers responsive and helpful customer support can make a significant difference when addressing concerns or issues that may arise during the contract term. Furthermore, potential customers should research online reviews and ratings to ensure the provider is highly regarded for its customer relations.

Contract terms are another vital aspect; it is advisable to look for agreements that offer flexibility. Prospective users should be cautious of long-term commitments, as these could lead to additional financial strain if circumstances change. Instead, seek out providers that offer month-to-month options or shorter contract lengths that provide customers with more control over their finances.

Additionally, it is important to examine any hidden fees or additional costs associated with the contract. Some providers may represent low monthly payments while embedding extra charges for specific services or fees for early termination. Transparency regarding these aspects is essential for informed decision-making.

Overall, when selecting a reputable mobile provider for a bad credit contract, attention to customer service, flexible contract terms, and the absence of hidden fees will greatly aid in securing a suitable mobile plan. By conducting thorough research and comparing several options, individuals with poor credit can find an agreeable solution that meets their communication needs while managing their financial constraints effectively.

The Importance of Reading the Fine Print

When navigating mobile phone contracts, especially for individuals with bad credit, understanding the fine print is essential. The terms and conditions are often extensive, and many consumers overlook critical information that can significantly impact their financial situation. One of the most prevalent pitfalls is hidden fees. These additional charges can crop up unexpectedly, often buried within the text of the contract, and can lead to higher overall costs than initially anticipated.

Another aspect to be mindful of is the penalties for late payments. Many mobile contracts include strict payment terms, and failing to adhere to these can result in hefty fines. These penalties not only increase the cost of the service but may also adversely affect credit scores, making future borrowing more challenging. Therefore, it is vital to understand the repercussions of timely payments versus the consequences of delays.

Additionally, the implications of early termination of contracts are often underestimated. In cases where a user may need to cancel their mobile service earlier than planned, the financial repercussions can be substantial. Many contracts include high cancellation fees, which can turn a seemingly affordable service into a costly burden. Recognizing these stipulations before signing can prevent unexpected financial strain down the road.

Furthermore, some agreements may automatically renew or include clauses that could lead to price increases after an initial promotional period. Reviewing the fine print with a cautious eye is not just a recommendation; it is a necessity for anyone considering a mobile phone contract, especially those with bad credit. A thorough understanding of the terms can lead to more informed decisions, allowing consumers to secure a deal that aligns with their financial capabilities without incurring unintended consequences.

Impact of Mobile Contracts on Credit Score

Entering into a mobile phone contract can significantly influence an individual’s credit score, particularly for those with a history of bad credit. When you sign a mobile contract, the agreement typically requires a credit check, where the provider assesses your credit history to determine your eligibility. If you have a poor credit score, this can limit your options, often resulting in the necessity to choose higher-cost plans or a prepaid option.

Timely payments on a mobile phone contract can serve as a positive factor in rebuilding credit. Many mobile service providers report your payment history to credit bureaus. As you consistently make your payments on time, you demonstrate financial responsibility, potentially leading to an improvement in your credit score over time. This process is gradual, and maintaining a regular payment schedule becomes crucial in establishing a positive credit history.

Conversely, missed payments or defaulting on a mobile contract can have detrimental effects on credit scores. Delinquencies may be reported to credit agencies, which can cause your score to decline. Since credit scores play a critical role in future borrowing capabilities, a decline can pose challenges in securing loans or additional credit lines. Notably, even a single missed payment can result in long-term repercussions, making it essential for individuals to avoid falling behind on their obligations.

In summary, mobile contracts can serve as a double-edged sword for those with bad credit. While they offer an opportunity to rebuild credit through responsible payment behaviors, the risks of falling behind on payments can severely impact one’s financial standing. Understanding these implications is vital for anyone considering entering into a mobile phone contract. By being proactive and diligent in managing payments, individuals can use these contracts to their advantage while safeguarding their credit status.

Alternatives to Mobile Phone Contracts for Bad Credit

Individuals with bad credit often face challenges when seeking mobile phone contracts, as traditional providers may impose stringent credit checks. However, there are several alternative options available that can help those with unfavorable credit histories stay connected without the need for extensive commitments.

One of the most popular alternatives is the prepaid mobile plan. These plans allow users to pay for service upfront, eliminating the need for a credit check. With prepaid plans, consumers can select from various options in terms of data and talk time, tailoring the service to their specific needs. The primary advantage of prepaid plans is flexibility – users can discontinue service at any time without facing penalties. However, these plans may not always offer the same network coverage or perks as postpaid contracts.

Another viable option is to consider refurbished phones. Refurbished devices, which are often available at significantly reduced prices, can be purchased outright without a contract. This approach enables individuals to own their phones and select a service plan that fits their budget. While refurbished phones can be economical, it’s essential to purchase from reputable sellers to ensure quality and warranty coverage.

Purchasing a phone outright from a retailer is also an option. Although this requires a higher initial expenditure, it allows individuals to avoid long-term commitments, offering freedom to choose a suitable pay-as-you-go service. Many retailers offer financing options that let buyers break down payments into manageable monthly installments, reducing the immediate financial burden.

In summary, individuals with bad credit can explore several alternative options to traditional mobile phone contracts. Prepaid plans, refurbished phones, and outright purchases present various advantages and disadvantages, making it crucial to assess personal needs and financial circumstances before making a decision. These alternatives can offer a viable solution, ensuring that connectivity remains accessible despite credit challenges.

Bad Credit Contract Mobile Phones