Mobile Phone Finance Bad Credit

Need help to find mobile phone finance bad credit? You are not the only one and like the thousands of individuals we have already helped, we are here to help you too.

Bad credit can be a problem when you are looking to take out a new credit agreement. A new mobile phone contract is also a new credit agreement, although some people do not realise this.

The mobile phone handset is subsidised by the network you connect to when you take out a 12, 18 or 24 month contract. That subsidy is used against the full retail cost of the handset to bring the price down to a much more affordable level. There are still bad credit mobile finance options no-matter what your past credit is like.

Mobile Phone Finance Bad Credit Customer

Jack from Birmingham was searching for mobile phone finance bad credit after being turned down by the mainstream phone providers. Jack had gone through a very difficult time personally and financially. Jack had been made redundant after the firm he had worked for for the past 30 years had gone in to administration.

Along with this his wife had been injured in a car accident and so had to take time off her own job. Due to his change in circumstances, he found it extremely difficult to keep up to date with his financial commitments.

As a result, he had several late payments on credit cards and found himself behind on the rent, which had a detrimental affect on Jack’s credit score. To get back on the employment ladder Jack was working hard to start his own business and needed a better phone that was capable of keeping up with the demands of the new business.

Shop For The Latest Smartphones

Jack knew that due to his financial history his credit profile was not in the best condition to be accepted for a contract phone. This is why Jack found himself in the position of searching for mobile phone with bad credit.

Jack is just one of the many people in the UK that are finding it increasingly difficult to keep up to date with their financial commitments due to a variety of reasons. You may be like Jack and finding it hard to cope.

Mobile Phone Finance Bad Credit Companies

We put Jack in contact with a company who works hard to help customers like him who have less than perfect credit scores find a mobile phone that they can be accepted for.

No matter how low and discouraged you may feel about your situation, there is always some one out there that can help you find phone finance having bad credit deals.

If, like Jack, you are looking for mobile finance but you have bad credit, we can point you in the right direction to companies that can help.

Get Mobile Phone Financing Today

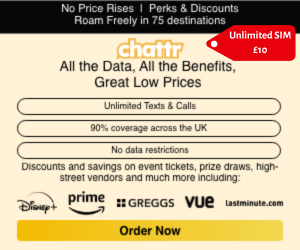

The process is free and is totally obligation free. Click on the banner to take you to companies that should be able to help you today. You may just find yourself on the way to getting the contract phone you desperately need.

If you don’t have the cash to buy a new phone, you can still get a cell phone with a deferred interest financing plan. Major carriers often offer this, hoping to encourage their customers to upgrade their phones and pay off the rest of the phone at once. Apple also offers 0% interest financing on certain devices, but it’s important to note that if you carry a balance on your card, interest will begin to accrue.

Another benefit of phone finance is building credit. A creditor must report your activity to the major credit bureaus. By following through on your payments, you can build a good credit history. You may not qualify for the lowest interest rates, but you can use this method to get a new phone.

However, be aware that if your credit score is bad, you won’t qualify for a 0% interest mobile phone finance plan. Fortunately, many major manufacturers offer mobile phone financing and report your payments to the major credit bureaus.

Leasing is similar to financing, but allows you to switch devices sooner. If you’re unhappy with your current phone after a certain period of time, you can always upgrade to a newer model. However, you’ll have to return it at the end of the contract. However, it’s often easier to manage a monthly payment with a leasing plan. This type of payment plan is often cheaper per month than a finance plan, but you’ll own the phone.

Feel free to browse our website pages and look for the best deals possible. All deals are updated every day, so check back again soon.

People often worry that signing a mobile phone contract will damage their credit score, but there are networks offering contracts without performing credit checks.

These devices tend to be cheaper smartphones rather than the higher-priced models available today, though you’ll still be required to make a deposit payment and may even need a guarantor in place before being eligible to lease one.

No credit check

There are a few mobile phone networks that provide mobile phones on finance no credit check UK and these deals tend to offer SIM only contracts and not the latest handsets. Furthermore, deposits will usually be returned once payments have been made for several months; such offers usually go only to people with excellent credit histories or history.

Before getting a mobile phone contract from any UK network, it’s likely you will undergo a credit check to ensure you can afford the monthly payments. When applying for your contract it is essential that you provide accurate information as too many searches could negatively affect your credit score and potentially impact its impact.

Your chances of passing a credit check can be increased by enrolling on the electoral register and making timely repayments on existing credit agreements. Furthermore, keeping old accounts open may help boost your score and improve your credit rating.

If you want a phone contract without going through a credit check, the best choice would be one from one of the major UK operators companies regulated by Ofcom. By choosing these companies you’ll know they are treating you fairly and responsibly while unregulated providers could use your details fraudulently.

No deposit

If you have poor credit but still require a contract phone, there are still options available to you. SIM-only deals, pay-as-you-go plans or applying with a guarantor may help improve your score and qualify for better contracts in the future. It is also wise to regularly review your credit report to identify any discrepancies which may cause issues when applying for credit.

Many networks conduct credit checks before offering you a contract phone plan, though some don’t. If your credit history is poor, they might require you to pay an initial deposit as insurance against failing to make payments; typically this deposit will become refundable once multiple months have been completed successfully. Additional ways you can improve your rating include registering on electoral rolls, refraining from applying for multiple loans at once and being sure any existing accounts are paid on time.

Bad credit history can make buying a mobile phone challenging, but there are companies that provide no credit check contract phones to those with poor credit histories. These providers take pride in providing outstanding customer service while offering various devices.

No interest

Those seeking mobile phone contracts without credit checks have various options available to them, and many are regulated by Ofcom, the UK communications watchdog. Ofcom ensures these companies treat customers fairly and responsibly; you can trust they won’t use your personal data for fraudulent activities. But it is important to remember that without proper management you could find yourself paying more in the long run; hence it is wise to keep an eye on your credit report regularly to avoid making too many applications at once.

Remember, too, that your interest payments depend on the value of the phone you purchase. Cheaper phones usually feature lower instalment amounts and thus require less stringent credit checks, while for high-end smartphones it may be harder to secure contracts that don’t involve a credit check.

There are various methods of obtaining a phone contract without being subject to a credit check, including SIM-only deals, paying as you go plans, applying with a guarantor and using specialised providers. When looking for the ideal contract offer it will also help your credit score as applying for it will bring down debt payments faster and be seen positively by creditors and credit bureaus alike. It is worth also regularly monitoring your credit report for errors so they can be addressed accordingly with creditors and bureaus.

No contract

As someone with poor credit, getting a mobile contract can be challenging. You might not be eligible for the latest phones and you might need to pay more upfront than someone with better credit would need to do. But there are still ways you can secure what phone you desire without breaking the bank – these options include SIM-only deals, paying as you go options, applying with a guarantor or choosing specialist providers.

Mobile phone providers will usually conduct a credit check when reviewing an application from potential subscribers to ensure they do not pose a fraud risk. If you’ve experienced rough financial times in the past, or still owe debts from years prior, then chances are it could harm your score and possibly prevent future contracts being approved.

Companies specialize in offering pay monthly phones without credit checks uk for people in these situations, providing mobile phone deals from Apple, Samsung and Huawei smartphones across all networks at discounted rates compared with purchasing the handset through traditional contracts. A deposit up front may be necessary; however this usually works out cheaper.